tn franchise and excise tax return

All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. Make an extension payment.

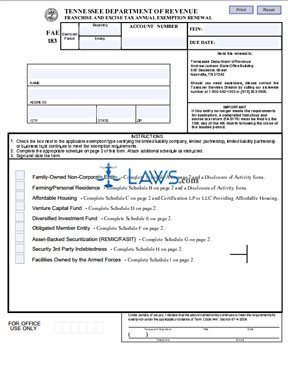

Fae 183 Fill Out And Sign Printable Pdf Template Signnow

To receive a six month extension a taxpayer must have paid on or before the original due date an amount.

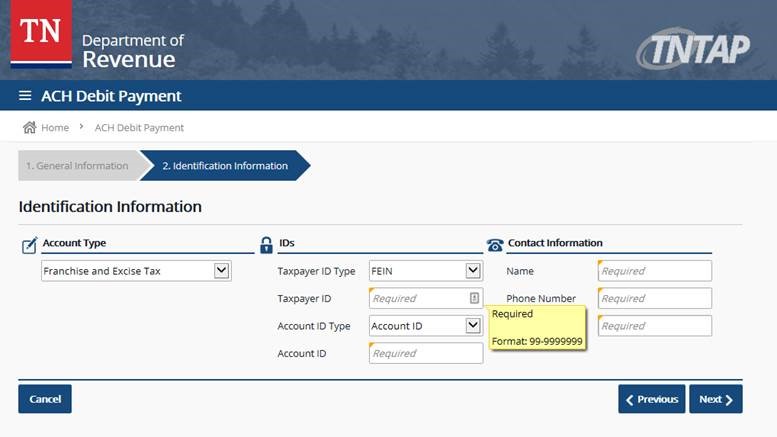

. Franchise tax may be prorated on short period returns but not below the 100 minimum. Click on Make an ACH Debit Payment or Make a Credit Card Payment hyperlink and provide the information as requested. Go to Screen 54 Taxes.

Select Tennessee SMLLC Franchise Excise Tax Return from the left navigation menu. These entities that are subject to the franchise or excise tax must file their own separate franchise and excise tax return. Tennessee Department of Revenue.

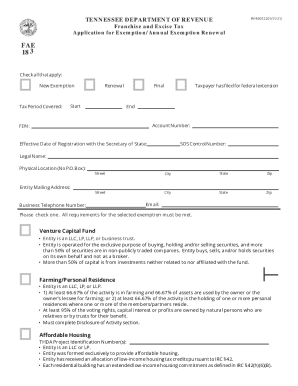

If you have questions about Franchise And Excise Tax Online contact. Download or print the 2021 Tennessee Form FAE-170 Franchise and Excise Tax Return Kit for FREE from the Tennessee Department of Revenue. General Information Enter the beginning and ending dates of the period covered by this return.

The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. FAE170 Franchise and Excise Tax Return. Select the applicable Activity name or number.

Download or print the 2021 Tennessee Form FAE-170 Franchise and Excise Tax Return Kit for FREE from the Tennessee Department of Revenue. TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Account Number Tax Year Ending NAICS Legal Name Mailing Address City State. Make quarterly estimated payments.

The excise tax is 65. Complete the Short Period Return Worksheets and retain them for your records when filing a. FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a General Partnership A limited liability company must file a franchise.

If applicable short period. The following entity types may be required to file the franchise and excise tax return. FE-9 - Extension for Filing the Franchise and Excise Tax Return.

TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Tax Year Ending Amended return Mailing Address City Legal Name State ZIP. File a franchise and excise tax return for an entity that only owes the 100 minimum franchise tax. Navigate to the main TNTAP page.

Important Notice 13-16 Single.

Free Form 183 Franchise And Excise Tax Annual Exemption Renewal Free Legal Forms Laws Com

Tennessee Cpa Journal May June 2015

![]()

Monthly Tennessee Tax Revenue Tracker For Fy 2020

Tennessee Revenue Department Extends Some Tax Deadlines To May 17 Wate 6 On Your Side

Franchise Excise Tax Obligated Member Entities Youtube

Fill Free Fillable Forms State Of Tennessee

Fillable Online Tn Franchise And Excise Tax Job Tax Credit Business Plan Franchise And Excise Tax Job Tax Credit Business Plan Tn Fax Email Print Pdffiller

Tennessee Rentals And The Fonce Exemption Mark J Kohler

Predators Edition All Caps All The Time For Tennessee S Franchise Excise Tax Obligated Member Exemption Carter Shelton Jones Plc

Tennessee Department Of Revenue Tntaptuesday Reminder Hall Income Tax Is Due July 15 You Can Conveniently File Pay From The Tntap Homepage Visit Tntap Tntap Tn Gov Eservices And Click File Hall Income Tax Tnrevenue

Permanent Tax Reforms Trump Sales Tax Holidays

Tennessee Franchise And Excise Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Fillable Online State Tn Tennessee Tax Franchise Excise Federal Income Revision Form Fax Email Print Pdffiller

Tennessee Clarifies The Application Of Marketplace Facilitator Legislation To Franchise Excise Tax Forvis

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Annual Tn Business Tax Seminar

Tennessee Form Fae Qtax Quarterly Franchise Excise Tax Declaration 2021 Tennessee Taxformfinder

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

Tennessee Allows Annualized Method To Determine Excise Tax Estimated Payments Kraftcpas